Social Investors’ Message on Client Protection: “Financial Service Providers Don’t Have to Do It Alone”

A new roadmap and certification program supports providers to implement client protection standards

Last week, CERISE and SPTF launched the Client Protection Pathway, a new initiative to support financial service providers (FSPs) to implement client protection. While the Client Protection Pathway is a roadmap for FSPs to follow, the initial demand for such an initiative came from social investors and funders. These companies wanted a way to identify FSPs who are committed to client protection and to support them to implement the Client Protection Standards.

I asked a few members of SPTF’s Social Investor Working Group to share why they are supporting their partners to join the Client Protection Pathway. Their top three reasons align with the three steps of the pathway and point to the importance of FSPs getting support for the hard work that client protection requires.

- Funders want to identify the truly committed providers.

- Funders want their partners connected to a global network for support.

- Funders are invested in the longevity and soundness of the industry.

The first step in the Client Protection Pathway is “Commit to implement client protection.” To take this step, an FSP agrees to implement the Client Protection Standards and creates an online profile that includes a list of their client protection assessments and achievements to date. FSPs that take this step are then posted on our website. We expect this list to become the industry’s main way of distinguishing the FSPs that are truly committed to client protection.

To this point, Emmanuelle Javoy of Symbiotics said: “When we first envisioned a new Client Protection initiative, the members of the SPTF Social Investor Working Group were very clear on this—they wanted an easy way to view the client protection progress of their partners and potential partners. They wanted something more than an empty endorsement. This list of committed FSPs will show us which institutions have signed the commitment to implement and what they have done so far.

The second step in the Client Protection Pathway is “Assess and improve practices.” In this phase of their client protection journey, an FSP evaluates their current practices, creates an action plan for building on their existing good practices and then gradually makes improvements over time. This is the step where CERISE and SPTF can really support FSPs with our how-to guides, trainings, a pool of technical assistance experts, funding facilities and more.

Edouard Sers of Grameen Crédit Agricole expressed enthusiasm over getting his FSP partners connected to these resources. “When the Smart Campaign closed late last year, I was concerned that the industry’s wealth of knowledge about client protection would slowly fade away. I’m relieved that what Smart started, CERISE and SPTF are picking up and running with. I want GCA’s FSPs as connected as possible to the latest standards and resources for client protection because I want them to keep learning, iterating and improving their performance.”

The final step in the Client Protection Pathway is “Demonstrate progress and achievements.” Here, we’re primarily referring to achieving Client Protection Certification. Last year, we surveyed dozens of FSPs and investors to find out what they need from a Certification program. Based on those results, SPTF and CERISE collaborated with several rating agencies to rework certification so that FSPs have more options, including a tiered approach to awarding certification. FSPs can now reach a bronze, silver or gold level of achievement. We are excited about these options because we think all progress contributes to creating safer conditions for clients and a sounder financial market.

Frank Streppel of Triodos IM pointed out that, ultimately, this is also one of funders’ top priorities: “In each of our lending covenants, we have requirements around client protection performance. We have high expectations for each of our investees. But as much as each provider is responsible for its own practices, we recognize that it’s only through collective action that we can ensure a stable industry. Over a dozen funding organizations have signed a joint statement calling on financial service providers to join the Client Protection Pathway. As a group, we want to encourage as many FSPs as possible to prioritize client protection.”

These three social investors – and the entire SPTF Social Investor Working Group – agree that client protection is a top priority for the financial inclusion sector and recognize that FSPs need support and an industry-wide effort to make real progress. By joining the Client Protection Pathway, FSPs can access this support and receive public recognition for their efforts. And as FSPs make progress along this pathway, it is of course the clients who will ultimately benefit.

Public-private dialogue charts digital way forward for inclusive green finance

Ensuring the sustainability of financial inclusion requires the creation of a wide range of financial products and services to encourage customers to make climate friendly choices, build their resilience to the impacts of climate change and facilitate the transition to a low-carbon future. Panelists at AFI’s public-private dialogue (PPD) focused on how to leverage digital financial services (DFS) for inclusive green finance (IGF).

IGF is taking shape in a number of countries and action on green finance is increasingly perceived as a part of the mandate of central banks. At the same time, strides are also being made at the private sector side with regards to mitigation and resilience building financial services and products. This is why this PPD is appropriate and timely.

AFI’s Director of Strategy and Financial Inclusion Policy Kennedy Komba pointed out the vital role of policymakers in mobilizing resources for climate action and ensuring financial and economic stability.

“Digital finance enabled far-flung communities to access electricity through solar energy as well as other technologies such as solar cookstoves,” said Komba, adding that digital technologies are also making insurance available to the most vulnerable groups which provide some sort of safety net for recovery, especially in these changing times.

The dialogue also emphasized the role of national strategies and digital literacy programs while pointing out that improved access to funding for specific initiatives from the private sector could have a multiplying effect on financial inclusion on the ground.

Panelists for the event included Jorge Moncoya, Intendente General Tecnico for Superintendencia de Economia Popular y Solidaria (SEPS) Ecuador, Cyril Benoiton, Financial Surveillance Analyst for the Central Bank of Seychelles, Khondkar Morshed Millat, General Manager for the Sustainable Finance Department for Bangladesh Bank, Serena Make, Deputy Head of Funding Asia for Home Credit Group, and Isaac Kibere, Senior Legal Counsel for Safaricom PLC.

Integrating DFS into financial inclusion policies is important in order to reach “the last mile” of vulnerable communities, especially in climate-related disaster events. AFI’s Head of Inclusive Finance, Johanna Nyman welcomed discussions on the intersect between DFS and IGF, especially given work that are already being done by the private sector on the ground on building resilience and mitigating the negative impacts of climate change.

The PPD event is a prelude to a special report on IGF and DFS, currently being developed by AFI’s inclusive green finance working group (IGFWG) and digital financial services working group (DFSWG). The event is also a first PPD for AFI’s IGF workstream.

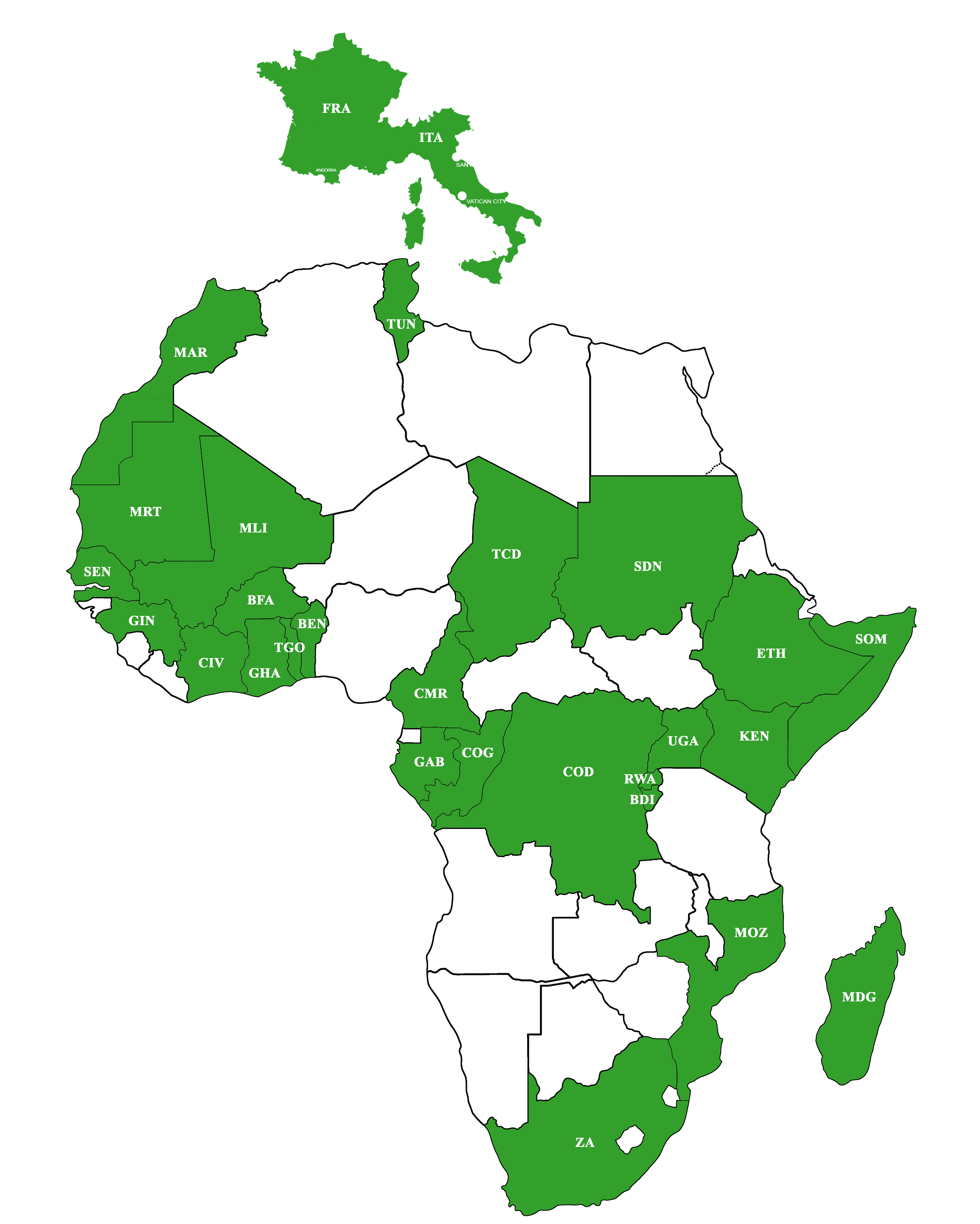

The event, held on 21 November 2021 and attended by over 70 participants from 38 AFI member institutions, is the first PPD organized in collaboration with the IGF workstream.

AFI’s PPD platform is a unique opportunity for AFI members to share practical insight and best practices among their peers, offering the chance to reflect on public and private interventions that can advance financial inclusion.

AFI’s IGF workstream is part of the International Climate Initiative (IKI), which is supported by the German Federal Ministry for the Environment, Nature Conservation and Nuclear Safety (BMU), based on a decision of the German Bundestag.

Upcoming Events

- Training : Take in hand the future of your IMF with MicroVision | Lome – Togo, January 2022

- Training : Ecological and Social Transition (EST) | Lome – Togo, February 2022

- Training : Ecological and Social Transition (EST) | Addis abeba – Ethiopie, February 2022

- AT : Assistance technique en Education Financiére | February 2022

- AMI : Coching en Transparence | Fevrier 2022

- Training : Digital Finance | Addis abeba – Ethiopie, March 2022