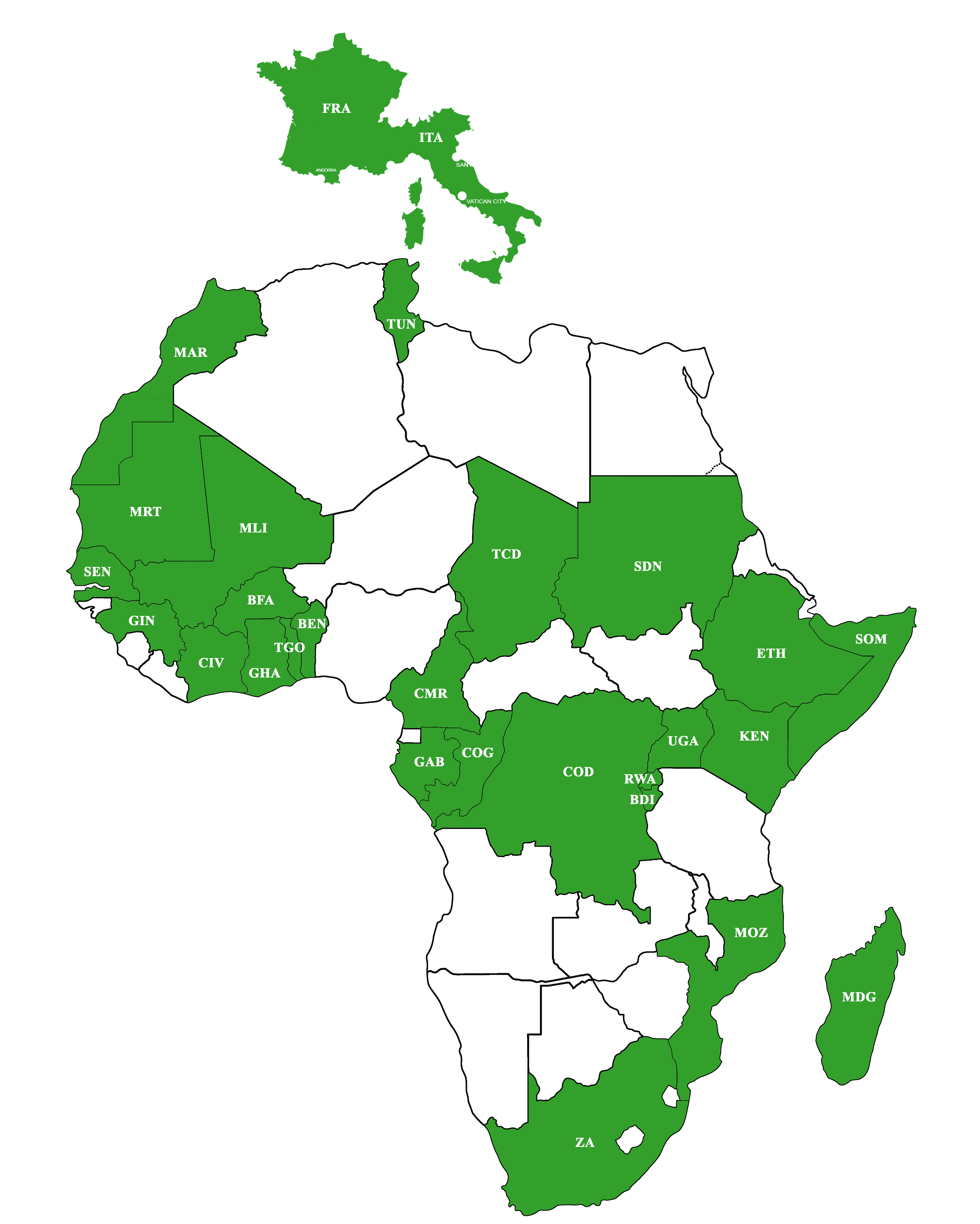

Training on” the Transparency in Practice” – Ouagadougou:

Of the 9 to July 11, 2019, MAIN organized a workshop on the setting in practice of the transparency in microfinance in Ougadougou in partnership with the APSFD of Burkina. The formation put the bases of the transparency concept applied to the domain of the microfinance, and approached the fluxes of information as well as the good practices to put in work in the institutions. The participants have been invited to exchange on their experiences and the tools standards of assessment and communication carrying so much on social and financial performances have been presented. The shop gathered 19 participants representing 11 institutions come of 5 countries of Africa.

Testimony of M. YAMEOGO, FINEC SA

FINEC SA Burkina, a structure of microfinance that applies the transparency in its daily management, in its relation with the clientele, with its equals, in the the collaboration and the sharing of information with the rest of the sector. We enrolled to this shop proposed by our APSFD to benefit of the experience of the some and of the other, we found the very rich content of it and dispensed by hardened formatters. Following this formation we are going to reinforce our practices of transparency because we learned that the transparency allows the institutions to win individually and collectively.

Testimony of Mrs. SEGUEDA Albertine, CPB

Without really know what I was to expect before the shop, I can assure you that this training was as useful as necessary for me and my institution, it will help us definitely to improve our management. As union representative, I won’t hesitate to share what I acquired like knowledge with my colleagues. It will allow us to perpetuate our institution and to surmount some difficulties. Thank you again with full transparency.

Testimony of BASSOLE Matthias, CMBF

I attended this training for my capacity building in governance and to integrate the transparency on the whole of our decisions. In a booming market, transparency is a powerful factor of development, trustworthy pledge of our members in our institution. The tools of transparency will permit us to reassure our members and to reinforce our credibility towards our partners for the refinancing or technical supports. The content of the workshop was indeed rich and trainers are demystified the topic, we intend to put a triennial plan of transparency based on the use of the tools landed quickly in place.

ASKY offers 12% of reduction for the participants to the SAM 2019:

The Pan-African airline company begins for the development of inclusive finance in the side of Week African of the Microfinance 2019, of the 21 to October 25 in Ouagadougou. All participants having their ticket of entry to the SAM are eligible for 12% dues reduction on the flights ASKY to the event. origin cities and conditions are retailed here: https://www.ada-microfinance.org/fr/informations-practices-sam.

The second rotating lounge of the SSE will take place to Senegal:

The Minister of Microfinance and Social and Solidarity Economy (SSE), Mrs. Zahra Iyane Thiam Diop, announced that the lounge will take place of October 26 to November 2, 2019 and will have for theme: “Social and Solidarity Economy, an alternative and inclusive model of entrepreneurship”. The event had taken place to Morocco the last year, it would be this year about making advance the reflection on the stakes of SSE, to propose some exhibitions and to reward innovation and creativity of social and solidarity entrepreneurship.

http://www.rewmi.com/salon-de-leconomie-sociale-et-solidaire-zahra-iyane-thiam-lance-les-activites-preparatoires-de-la-2e-edition.html

CEMAC inform on the new setting authorized of the services of payment:

July 22 to Djamena, Chad, more than 250 actors of the financial sector were united by the Central Bank of Central Africa States (BEAC) and the Banking Commission of central Africa (COBAC) to exchange on the relative regulation evolution to the new services of payment. It was question of the use of the automatic ticket windows of bank, of electronic payment terminal, of prepaid cards, of payment by computer and cell phone. The reform has been motivated by all changes that have taken place in the sector, notably with the technological innovations that accelerated digitalization of regulations and financial transactions.

http://www.adiac-congo.com/content/cemac-vulgarisation-du-nouveau-cadre-reglementaire-des-services-de-paiement-103199

Microfinance: rise of 16% of the deposits in Togo, to the 1st quarter 2019

FINANCE Tuesday, August 13, 2019 13:26,

Microfinance: rise of 16% of the deposits in Togo, to the 1st quarter 2019

(Togo First) – For the first quarter of this year 2019, Togo records a rise of 16,0% of the deposits in the institutions of microfinance or decentralized financial Systems (SFD), inform the Central Bank of West Africa States, in its last report on the situation of microfinance in WAEMU erea (West-African economic and monetary Union).

With such a progression of the deposits, Togo stands second in the Zone, for relevant period, behind Mali (+20,0%), and before, respectively, the Coast of Ivory (+15,1%), Senegal (+10,3%), Benin (+9,9%), Burkina (+3,7%) and Niger (+0,5%).

results to compare with the fact, that in 2018, the country recorded the most important rise of the deposits in the union.

Note also that, overall , the amount of deposits collected for this quarter in the waemu settled in 1390,8 FCFA billions against 1248,7 FCFA billions, one year earlier, what represents 11,4% progression in the same way, the access of the populations to financial services provided by microfinance institutions increased of 10,4%, slightly year-on-year.

Ayi Renaud Dossavi

To read also:

https://www.togofirst.com/fr/finance/2204-2991-uemoa-le-togo-enregistre-la-plus-importante-hausse-des-depots-dans-les-etablissements-de-microfinance-en-2018