I- Green financing could help Africa mitigate climate change effects

African countries should explore innovative green financing mechanisms to promote a green transition to mitigate the effects of climate change, experts attending the annual UN Economic Commission for Africa’s Conference of Ministers of Finance, Planning and Economic Development (COM2024) in Victoria Falls, Zimbabwe, said last week.

Veronica Jakarasi, Chief Director, Climate and Meteorological Services of Zimbabwe stressed the need to support environment friendly investments like climate smart agriculture to mitigate climate change.

“To attract green financing, Africa needs to have policy and regulatory frameworks with set targets in line with ambitious development,” said Ms. Jakarasi.

II- New members

The board of directors which met on May 30, 2024 in ordinary session admitted 4 new institutions as members of the MAIN network. These are: COOPEC TOGO PORT in Togo, WAKILI SA in Guinea Conakry, Caisse Baitoul Maal (CBM) in Burkina Faso and the Solidarity Fund for Education Workers (FSTE) in Burundi. The MAIN board of directors as well as the Executive Management welcome the new members to the pan-African network and hope to continue with them capacity building actions for responsible, social and ethical inclusive finance.

III- Exam Results for the Professional Diploma in Microfinance: Customer Relationship Manager & Branch Manager

Following the launch of this first wave of training with three professional associations (APSFD Senegal, ANIMF & APROCEC of the DRC), the participants sit for exams on December 6 & 7, 2023. In total ninety-four (94) participants wrote for the professional branch manager while thirty-seven (37) participants wrote for the professional customer relationship manager course.

The Delivery Jury took place on February 27, 2024 and the results were announced to the professional associations on February 29, 2024. For the professional branch manager program, out of 94 registered, 70 were declared admitted, i.e. a success rate of 74.46%. Regarding the professional customer relationship program, out of 37 registered, 31 were declared admitted, representing a success rate of 83.78%. Overall, we note that the results are very satisfactory. The beginning of the training for the 2024 session is planned for July.

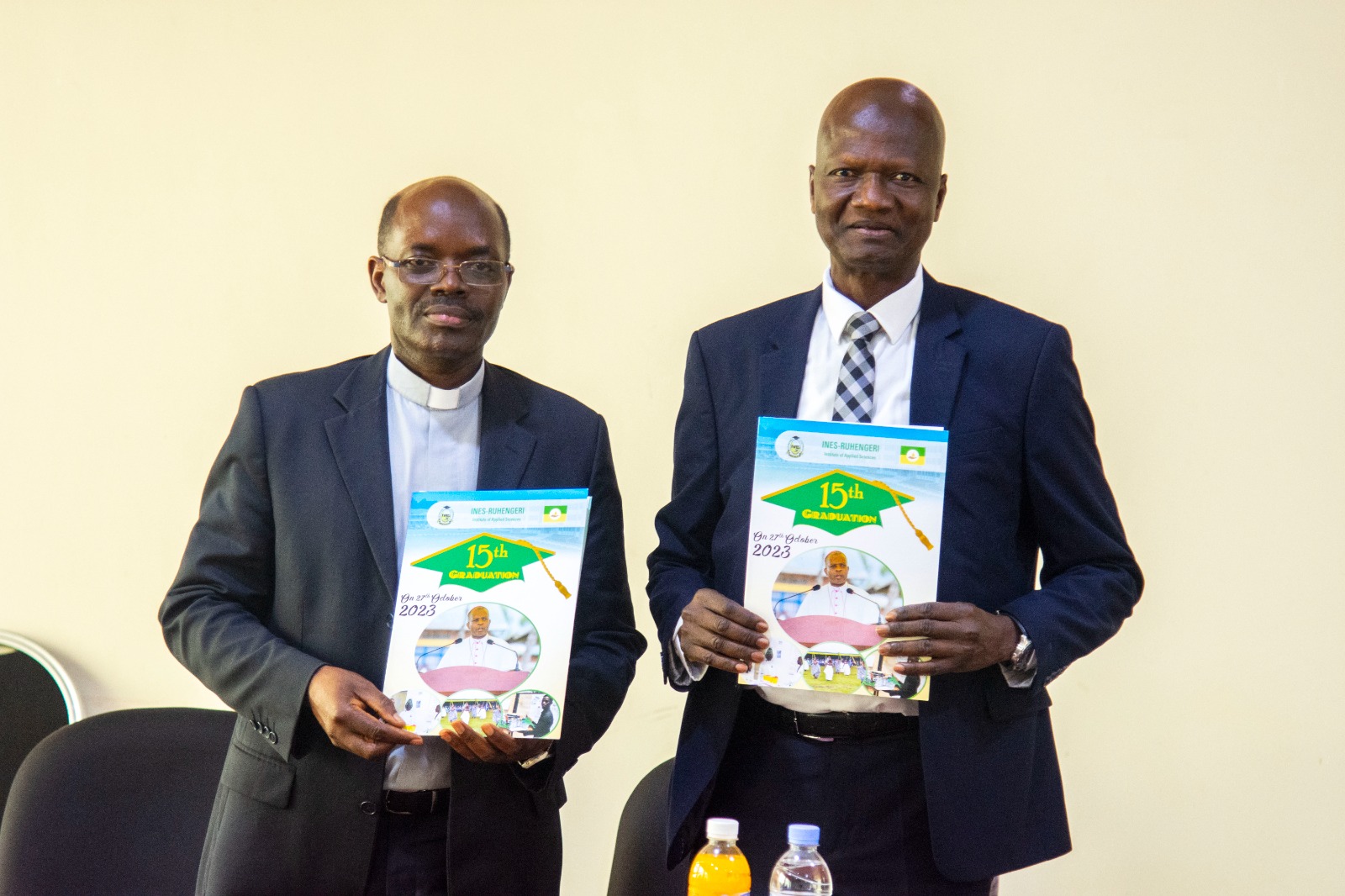

IV- Signature of the MAIN & INES Rugengeri agreement and launch of the new master’s program

On May 9, 2024, the chairman of MAIN and the Vice Chancellor (VC) of Ines Ruhengeri signed the memorandum of understanding between the two institutions. This signing ceremony took place within the university in front of the teaching staff and administrative staff of the university. This collaboration aims to set up a master’s program in microfinance for English-speaking members of MAIN. For the VC of the university, everything will be done for the success of this program. As for the chairman of MAIN, he was delighted with the welcome and the arrangements made for the effectiveness of this signing of the convention. He urged the English-speaking members to benefit massively from this program and recommended that the university should take this program very seriously for its the notoriety even beyond Rwandan borders. It is in the quest for excellence and diversification of technical partners that this program was created.

This master’s degree in Microfinance is designed to develop and strengthen the skills of financial inclusion stakeholders for more efficient and healthy management of their institution. This two-year hybrid program (face-to-face and online program) will allow MFI executives to equip themselves with innovative tools for good management of a microfinance institution. Registrations for the first class have started and the beginning of the academic year is scheduled for August 2024.

V- Call for applications to host SAM 2025

In partnership with the Luxembourgish Ministry of Foreign and European Affairs, Defence, Development Cooperation and Foreign Trade (MFA) and the MAIN network (Microfinance African Institutions Network) based in Togo, ADA (Appui au développement autonome) is launching a call for applications for host countries for the next edition of the African Inclusive Finance Week (SAM) in October 2025.

For more info click on the folowing link : https://www.ada-microfinance.org/en/sam/call-applications-host-sam-2025

VI- 5th Edition of the Microfinance Graduation Ceremony

In partnership with Microfinance African Institutions Network (MAIN) and the Ecole Supérieure de la Banque (Esbanque), the Professional Association of Microfinance of Senegal organized two professional certificate training sessions in “Customer Relationship Manager” and “Branch Manager” in year 2023.

Thus, following the training and the announcement of the exam results for obtaining the certificate of “Customer Relationship Manager” and “Branch Manager,” the professional association of microfinance institutions of Senegal organized the 5th edition of the graduation ceremony for the 68 recipients from the two 2023 cohorts. Indeed, this event constitutes a significant moment of symbiosis and sharing between authorities, professionals of the industry and their families to pay tribute to the pioneers (both men and women) who embody the values of the Microfinance sector in Senegal.

In this regard, the Board of Directors of APSFD-Senegal, through this activity, sought to honor the efforts and commitments of two pioneers in the sector, namely Mr. Boubacar BA and Mrs. Ndeye Sophie DIAW, for their contribution to the promotion of Microfinance in Senegal and the influence of the professional association. This edition, which also honors the 8th Customer Relationship Manager cohort and the 5th Branch Manager cohort of 2023, was sponsored by the National Microfinance Fund and presided over by the Minister of Microfinance and the Social and Solidarity Economy.

Upcoming Events

- Training on emotional intelligence: development factor for MFIs, Cotonou, Benin, July 2024

- Training on the digitalization of agricultural value chains, Lomé Togo, August 2024

- Master’s program in microfinance for French speakers, UCAC August 2024

- Master’s program in microfinance for English speakers, Ines Ruhengeri, August 2024