Download the registration form here

Training on “MANAGEMENT AND ASSESSMENT OF VULNERABILITIES”

Venue: Kigali- Rwanda| Duration: 3 days

-

Background and Justification

The MAIN Network (Microfinance African Institutions Network) is an international non-profit organization founded in 1995 in Abidjan. Since its creation, it has worked to strengthen the capacities of microfinance practitioners in Africa by implementing programs aiming to promote responsible and inclusive finance. Through its activities, MAIN is fully committed to promoting the Social and Solidarity Economy (SSE), thereby contributing to the continent's economic, social, and environmental development.

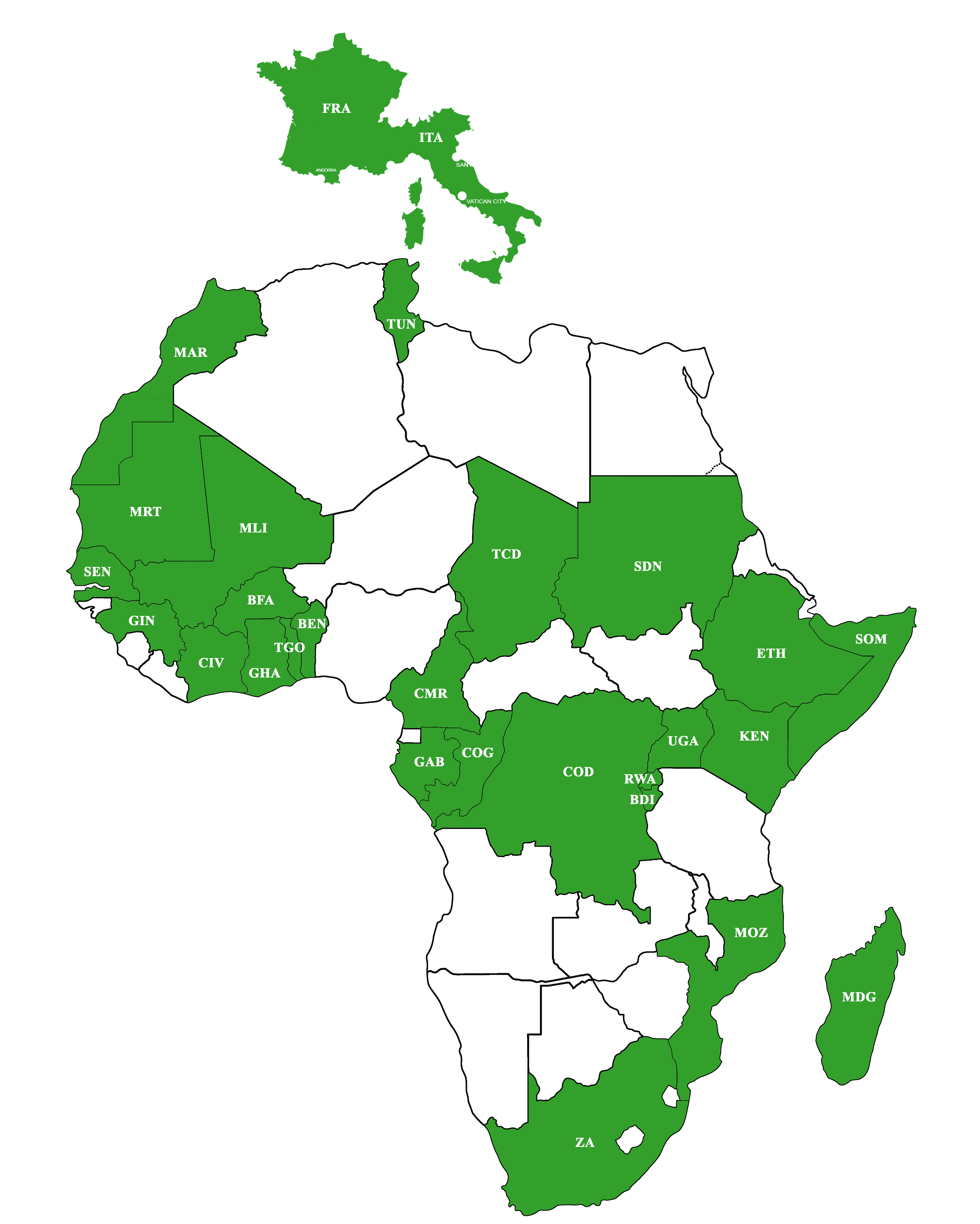

As at December 31, 2024, MAIN counts 141 members from 28 countries in Africa and Europe, including microfinance institutions, professional microfinance associations, NGOs, cooperatives, banks, and organizations specializing in research and social investment. All share a common goal: facilitate access to financial services for vulnerable populations and strengthen community resilience in the face of ever-growing economic and climatic challenges.

Among these challenges, increasing social and environmental vulnerabilities are a major concern. Low-income populations are often the first to be affected by climate change and economic crises, exacerbating their precariousness. Prolonged droughts, floods, crop failures, fluctuating food prices, and limited access to financial and social services are all factors that further weaken the living conditions of millions of people.

Face to these realities, it is becoming imperative for microfinance institutions and inclusive finance stakeholders to adopt a proactive approach to anticipate, identify, and manage these vulnerabilities. It is no longer simply a matter of offering financial services, but of ensuring that these services integrate adaptation and resilience mechanisms adapted to the specific contexts of the populations concerned.

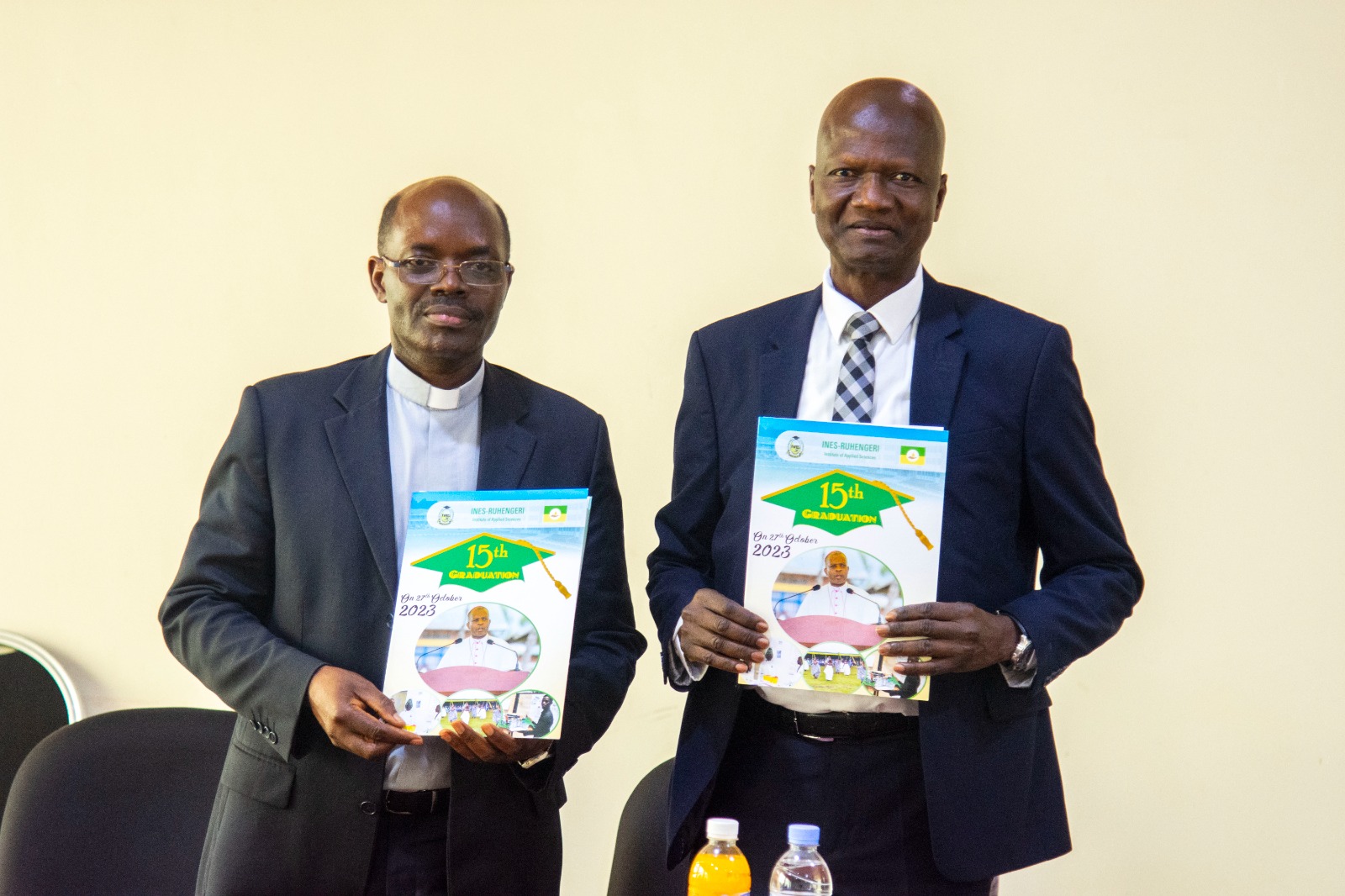

It is in this regard, that MAIN in collaboration with AMIR is organizing a three-day training course in Rwanda, bringing together participants from different countries to exchange on how MFI can better face these challenges. This training aims to strengthen MFI skills in vulnerability management and assessment, by providing them with concrete tools to analyse risks, design resilience strategies and evaluate the impact of the actions implemented.

- Training Objectives

General Objective

Strengthen the capacities of inclusive finance stakeholders in the management and assessment of climate and social vulnerabilities for greater resilience of vulnerable populations.

Specific Objectives

- What are the climate risks to which MFI clients are exposed?

- Climate vulnerability and credit risk

- Understanding the specific vulnerabilities of low-income populations to climate and social change.

- How to manage client and portfolio climate vulnerability

- Design resilience strategies and contextualized adaptation mechanisms.

- Master the methods of monitoring and evaluating vulnerability management programs.

- Promote experience sharing and best practices between MFIs.

- Cite some indicators and experiences to manage the vulnerability of MFI clients.

- Target Audience

The training will bring together primarily professionals from the microfinance sector (MAIN members and non-members) and key stakeholders involved in promoting inclusive finance and addressing climate vulnerabilities. The diverse range of participants will ensure a holistic approach and multi-faceted discussions.

- Expected Results

At the end of the training, participants will be able to:

- Explain climate risks to which MFI are exposed

- Explain climate vulnerability and credit risk

- Analyze EST vulnerabilities through structured evaluation grids.

- Develop action plans to integrate climate and social risk management into their institutions.

- Manage clients and portfolio climate vulnérability

- Use concrete tools: risk mapping, resilience indicators, adaptation program models.

- Share best practices with a regional network of inclusive finance players.

- Propose gender-transformative solutions to address inequalities exacerbated by climate change

- Training Content

- The program for this training will cover several essential themes, including: Introduction: Vulnerability

- The Role of Microfinance Institutions

- Presentation of Climate Risks to Which MFI Clients Are Exposed

- Vulnerability of Borrowers

- Negative Environmental Impact

- Analysis of Climate and Social Risks and Vulnerabilities

- Economic Vulnerability

- Social Vulnerability

- Cultural Vulnerability

- Establishment of Mechanisms for Adaptation to Climate Change

- Green Financial Products and Their Multiple Services

- Development of Social and Economic Resilience Strategies

- How to Develop Effective and Sound Environmental Strategies

- Managing Environmental Strategy

- Designing Programs to Mitigate the Impact of Vulnerabilities on Beneficiaries of Inclusive Financial Institutions

- Role of Sustainable Microfinance

- Monitoring and Evaluation of Programs to Measure Their Effectiveness

- Monitoring Green Strategy and Progress

- Monitoring Vulnerability Reduction

- Sharing Experiences and Best Practices

- Promoting Collaborative Learning

The training will run from July 28 – 30, 2025 in Kigali.

Deadline for registration is June 18th, 2025

The following requirements should be fulfilled to attend the program.

A registration fee of USD 250 must be paid to MAIN by member organizations, USD 300 for non-member of MAIN and USD 650 for international participants who are MAIN member and coming from another country than Rwanda.

Registrations form should be sent to main@mainnetwork.org with copy to m.djade@mainnetwork.org.

Participants who failed to pay the registration fee will not be accepted by MAIN. Registration fees are paid in cash upon arrival on the training site.

International Candidates are requested to arrange their own international travel and MAIN will make reimbursement up to USD 400 upon presentation of flight ticket receipt, and boarding pass along bank details immediately after the session is over. Please note that the cost of air ticket exceeding USD 400, the difference will be covered by the participant institution.

International Participants will be lodged by MAIN for 4 nights. Meals and rooms are provided by MAIN for international participants.

Member institutions are requested to clear their arrears of annual contribution to MAIN before attending the training.

Who is the trainer?

Denise Murebwayire is a distinguished expert in Microfinance, and sustainability with over two decades of experience. She currently serves as the Senior Advisor in Banking and Microfinance and Access to Finance Key Expert. Denise is a Certified Trainer in Corporate Governance and an International Certified Expert in Microfinance, having designed different financial products especially green products which impacted more than 5000 households. She holds key leadership roles, as board member in public institutions in Rwanda and has been in leadership of Microfinance umbrella in Rwanda, AMIR.