CELEBRATION OF THE 30TH ANNIVERSARY OF THE MAIN NETWORK: THREE DECADES AT THE SERVICE OF INCLUSIVE FINANCE IN AFRICA.

On May 16, 2025, Cotonou, the economic capital of Benin, hosted the official launch ceremony for the 30th anniversary celebrations of the African Microfinance Institutions Network (MAIN). This major event on a continental scale marks a decisive step in the history of a network that has been committed to inclusive finance for economic and social development in Africa for thirty years.

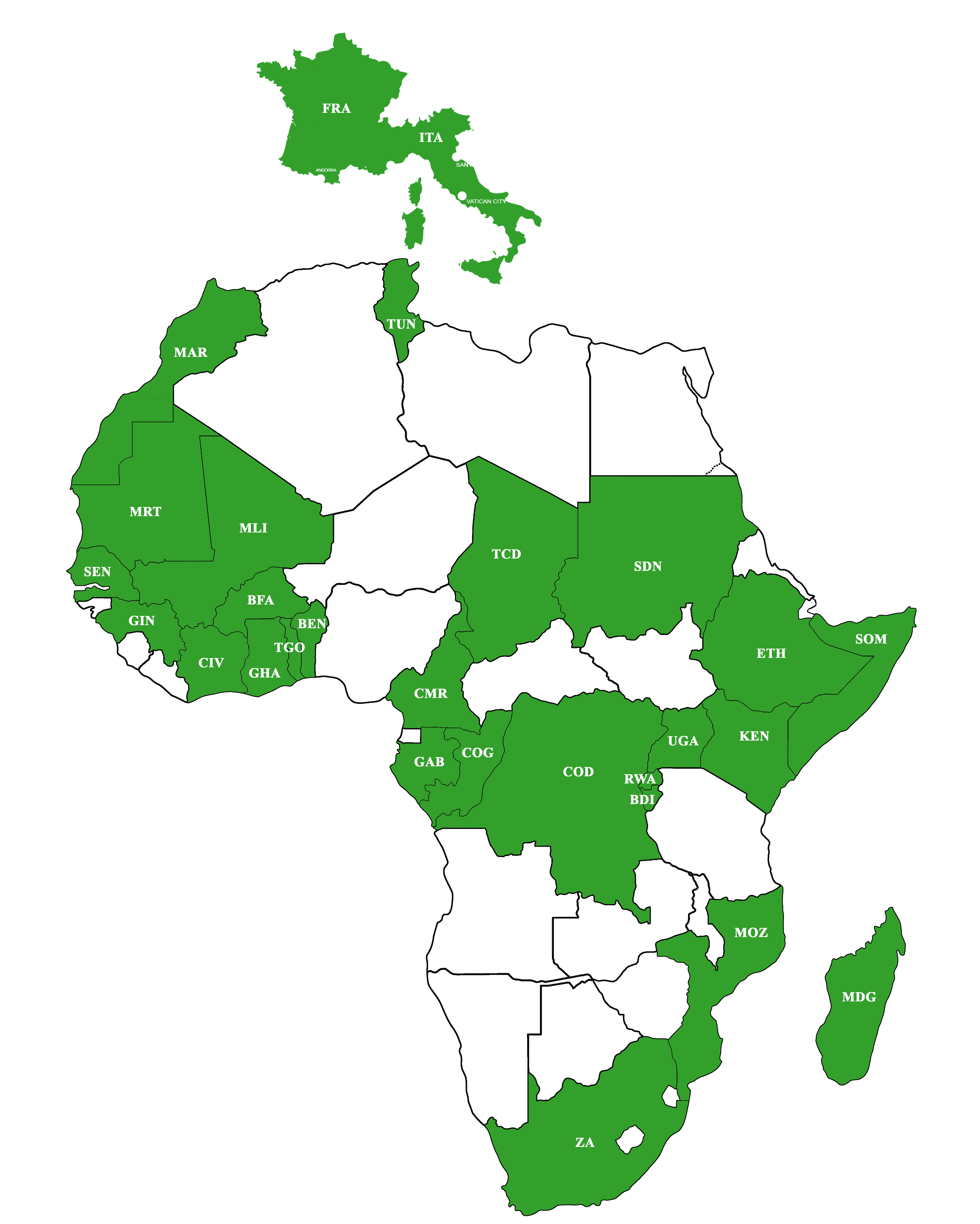

Founded in 1995 in Abidjan, MAIN is a non-profit association that now brings together 141 members in 28 countries. These members, drawn from a diverse range of microfinance stakeholders (institutions, cooperatives, NGOs, banks, research centers, etc.), collectively serve more than 16 million beneficiaries. Over the past 30 years, the network has established itself as a key platform for training, cooperation, and innovation to strengthen the sector’s technical and institutional capacities.

The opening ceremony was held under the auspices of Ms. Véronique Tognifodé, Minister of Social Affairs and Microfinance of Benin. In her speech, she expressed her country’s pride in hosting such a celebration, highlighting the progress made in Benin and the structural reforms in regulating the sector. She emphasized the importance of a network like MAIN in supporting states in consolidating their financial inclusion policies.

In the welcoming address delivered to the President of the Professional Association of Decentralized Financial Systems of Benin (APSFD-Benin), Ms. Valentine Huguette ADOUKONOU, she welcomed the presence of participants from diverse backgrounds, while highlighting the major challenges facing the sector, including climate risks, precariousness and insecurity. She also expressed the hope that the National Microfinance Week would be a space for fruitful exchanges, concrete commitment and collective mobilization in the service of the development of our sector and the well-being of our populations.

For Mr. Yombo ODANOU, Chairman of the Board of Directors of MAIN, the acceptance by the senior Beninese authorities to offer their hospitality to host this ceremony launching MAIN’s 30th anniversary in a pioneering country, a bearer of innovation and resilience in the microfinance sector, gives our commemoration a special sparkle. This is a recognition of the progress made, but also a renewed call to build together the foundations of a future where microfinance will be ever more impactful, fair, and humanly dignified.

Alongside the Minister, several international delegations were present. These included representatives from Togo, Morocco, Kenya, Burundi, and Uganda. Also noteworthy was the level of mobilization of MAIN members from Benin, as well as the sector’s technical and financial partners, who traveled to support the event. This mobilization demonstrates the recognition of MAIN’s role in structuring the microfinance sector on a continental scale.

This launch ceremony for MAIN’s 30th anniversary was also an opportunity for MAIN’s Executive Director, Mr. Mohamed ATTANDA, to give a detailed presentation of the network (mission, activities, results obtained, challenges & perspectives, partners, etc.). Today, MAIN has to its credit the organization of 13 international conferences, 47 university program sessions, 91 thematic training courses, 19 exchange visits between practitioners, and 11 scientific publications serving the professionalization of the sector. Through these activities, more than 4,200 practitioners have been trained, contributing to strengthening the resilience and performance of member institutions.

This celebration also laid the foundation for future prospects. The network aims to strengthen its hybrid training programs, develop training courses on specific themes, and expand its South-South partnerships. It is also committed to supporting rural institutions in crisis areas to ensure sustainable access to appropriate financial services.

Furthermore, the celebration of MAIN’s 30th anniversary is part of the momentum of the National Microfinance Week, scheduled for September 22-26, 2025 in Cotonou. This strategic meeting will be an opportunity to bring together stakeholders to discuss transformations in the sector and co-construct solutions to current challenges: access to energy, the development of green products, climate-smart agriculture, climate-related security issues, etc.

To review the highlights of this celebration, you can watch an excerpt from the official video of the event: https://www.youtube.com/watch?v=VC-wYbsDywc

GREEN REAL ESTATE LOAN IN AFRICA: A DOUBLY BENEFICIAL OPPORTUNITY FOR MFIS AND THEIR CLIENTS

In Africa, demographic pressure and accelerated urbanization are deeply transforming urban dynamics. The continent will need to accommodate nearly 2.4 billion inhabitants by 2050[1], a huge challenge in terms of housing, infrastructure and sustainability. However, this growth is all too often characterized by precarious, energy-inefficient, poorly planned and environmentally unwise construction. Faced with this situation, the housing sector represents not only a challenge, but also a tremendous opportunity to reinvent financing and construction models. This is where microfinance institutions (MFIs) can play a decisive role, by integrating into their offerings a tool that is still under-used but has immense strategic potential: green real estate loan.

Green real estate loan, or ecological real estate loans, refer to financing intended to support real estate projects that incorporate clear environmental criteria, whether these are new sustainable constructions, energy renovations or the integration of renewable energy equipment.[2]This type of loan meets a dual imperative: improving access to decent and resilient housing for populations, while actively contributing to the ecological transition of the continent.

For African MFIs, the risks are high. Offering green real estate loans represents a real opportunity to diversify their product portfolios, allowing them to target a new clientele: young urban dwellers, female heads of household, and families concerned about their health and energy costs. By integrating ecological criteria into their loan offerings, MFIs can attract these profiles, who are increasingly sensitive to environmental issues. Beyond expanding the customer base, this approach also helps strengthen customer loyalty by supporting households in projects with high added value—economic, social, and environmental.

Strategically, MFIs that engage in this approach will also benefit from a better brand image. By positioning themselves as players in sustainable finance, they will gain visibility and appeal to international donors, impact investors, and public and private partners committed to the fight against climate change. In a global context where ESG (Environment, Social, Governance) criteria are becoming increasingly important, institutions that align their actions with these values are opening up access to new sources of financing, such as green bonds, climate funds, or specialized credit lines such as those offered by the Green Climate Fund or the French Development Agency.[3].

The environmental impact of these loans is also far from negligible. By financing the construction of green buildings (using local materials such as stabilized earth, bioclimatic techniques, and solar equipment), or the energy renovation of existing homes, MFIs indirectly reduce greenhouse gas (GHG) emissions. Indeed, the construction sector is responsible for nearly 37% of global CO₂ emissions.[4]In Africa, where 60% of urban housing is still informal[5], the potential impact is immense. Initiatives like Kubik in Ethiopia show that it is possible to combine sustainable construction and affordability, while creating local green employment sectors.

But how can MFIs concretely integrate green real estate lending into their strategy? First of all, this requires the development of suitable financial products, with longer repayment periods, subsidized interest rates and climate micro-insurance mechanisms. It is also essential to train staff in ecological criteria and develop simple advisory tools for clients to support them in planning and optimizing their projects.

Creating strategic partnerships is another essential lever. By collaborating with sustainable construction experts, specialized NGOs, or green technology providers, MFIs can not only access valuable technical expertise but also facilitate their clients’ access to the most suitable and cost-effective solutions.

Certainly, challenges exist: higher initial costs, lack of awareness of green technologies, and a lack of clear standards. But they are not insolvable. Governments can play a catalytic role by creating incentive mechanisms (subsidies, tax breaks, green loan guarantees), while MFIs, through their proximity to communities, can raise awareness, train, and build resilient territorial ecosystems. In this way, they are not just offering loan: they are supporting a true paradigm shift in African housing.

In conclusion, green real estate lending is neither a utopia nor a luxury. It is a pragmatic, strategic, and deeply ethical lever. By adopting it, African MFIs have a unique opportunity to reconcile financial inclusion, social justice, and ecological transition. They can become pioneers of a more sustainable, more resilient development model, better suited to the challenges of the 21st century.

Now is the time to take action – for communities, for the planet, and for the future of inclusive & social finance in Africa.

DEVELOPING GREEN LOANS: AN OPPORTUNITY FOR AFRICAN MFIS

Microfinance Institutions (MFIs) are called upon to innovate in the face of growing challenges linked to poverty, limited access to essential services and the effects of climate change. The experience of ADA and REDCAMIF in Central America between 2018 and 2021 demonstrates that it is possible to develop green financial products that address these challenges in a concrete and inclusive manner.

This program, implemented with the support of 18 MFIs spread across Guatemala, El Salvador, Honduras, Nicaragua, Panama, Costa Rica, and the Dominican Republic, has created a green loan offering for low-income populations. Its objective: to improve their quality of life while supporting the ecological transition of the regions.

More than 2,400 customers have benefited from these green loans, in areas ranging from access to solar energy to sanitation, sustainable agriculture, ecotourism and even ecological housing.

Green products with many faces

In total, six major categories of green credits have been developed by the supported MFIs:

- Credit for access to solar energy: installation of solar panels to produce electricity or hot water;

- Water and Sanitation (WASH) Credit: connection to the network, construction of sanitary facilities, installation of rainwater collection systems or organic waste treatment;

- Green housing credit: energy renovation of housing for greater comfort and less expense;

- Credit for sustainable agriculture and livestock: improving agricultural practices to cope with climate change (water management, reproduction, waste management);

- Credit for sustainable family farming: support for small breeders through environmentally friendly silvopastoral techniques;

- Credit for ecotourism: construction or renovation of sustainable tourist infrastructure in areas with high local potential.

A customer-centric approach: a key success factor

The program’s success also stems from the methodology used: “Customer Centricity.” This approach places the needs and constraints of beneficiaries at the center of the product design process. It also incorporates feedback from employees, partners, suppliers, and communities to develop products that are truly adapted to the field and have a strong social impact.

This participative process, inclusive and results-oriented approach is essential to ensure massive and sustainable adoption of green products, particularly among vulnerable populations.

Read the article: ADA

How about Africa? An emerging green market

As Africa faces major environmental challenges – desertification, water stress, food insecurity, rapid urbanization – the development of green financial products represents a strategic opportunity for the continent’s MFIs.

However, according to recent estimates, only 10 to 15% of African MFIs currently offer specifically green products.[6] This rate is still low, despite encouraging market trends.

In partnership with African MFIs, MAIN promotes the emergence of green finance. MAIN believes that African MFIs can play a central role in the inclusive ecological transition. They are close to communities, understand their realities, and have the capacity to innovate in direct response to their needs.

MAIN stands ready to support member institutions wishing to launch or strengthen their green finance strategy. This includes:

- strengthening the capacities of technical and operational teams,

- support for the design of green products adapted to local realities,

- sharing successful experiences such as that of Central America,

- and networking with technical or financial partners involved in climate and social issues.

A call to action for African MFIs

The Central American experience proves that green loans are much more than just a financial product: they are powerful tools for reducing poverty, strengthening the resilience of populations, and promoting harmonious territorial development.

In an African context marked by strong environmental vulnerability but also by undeniable entrepreneurial energy, it is time to seize this opportunity.

REFUGEE WOMEN IN CONGO SOW THE SEEDS OF CHANGE THROUGH CASH TRANSFERS

In a world gripped by increasing humanitarian crises, the story of refugee women living in Igné, in the southern Republic of Congo, offers a glimmer of hope. According to an article published by the World Bank, these women, who came from Rwanda after fleeing violence, experienced exile, loss of direction, and precariousness. However, their journey changed through the Lisungi program, a social protection project launched in 2014 by the Congolese government with support from the World Bank. This program relies on a combination of complementary interventions that go far beyond simple assistance: conditional cash transfers linked to children’s schooling and health, vocational training, and grants to encourage the creation of small businesses.

For women like Claudine Moukabagwiza, a Rwandan refugee and now president of an agricultural cooperative, this program has represented much more than a one-off aid. It has marked a turning point in her life and in the lives of the 24 women who work alongside her. When they arrived, they owned nothing. Today, they cultivate the land, save, buy plots of land, and plan to expand their production. Their association, symbolically named “Wealth is found under the ground“, illustrates this ability to transform extreme difficulties into sustainable opportunities. This change was made possible by the technical and human support of the Lisungi program, which also introduced the use of digital payments via mobile to ensure security, efficiency, and transparency.

Since its beginning, Lisungi has supported more than 170,000 people across the country. It is not just a social project, but a model for community-based economic transformation, a model whose relevance becomes even more evident when looking toward the eastern Democratic Republic of Congo which has been struggling with conflict. In the provinces of North and South Kivu, hundreds of thousands of people continue to flee violence. Women, very often on the front lines, bear the responsibility of ensuring their families survive in particularly difficult conditions. Given this situation, the experience of the Lisungi program offers concrete solutions.

Read the article: The World Bank

Concrete inspiration for the East of the DRC

Transposing such an initiative to the fragile contexts of eastern DRC could tile the way for a more sustainable response than traditional humanitarian aid. By focusing on the empowerment of displaced people, particularly women, such an approach would not only strengthen their dignity but also promote their integration into local economic dynamics. It could also play a major role in strengthening social cohesion between refugees and host communities, through transparent, participatory, and equitable mechanisms. The specific needs of refugee women—access to land, savings, and children’s education—could be addressed in a targeted and structured manner.

In a context of extended crisis, where emergency aid remains essential but insufficient, a hybrid program like Lisungi, which combines humanitarian and development actions, makes it possible to consider sustainable and inclusive solutions. To give this type of initiative the scope it deserves, the role of financial institutions is crucial. The World Bank has shown, with Lisungi, that a strategic and well-directed partnership can help implement innovative public policies and anchor them sustainably in institutional arrangements.

Local and regional banks, for their part, can play an essential role in securing payments, disseminating accessible financial services and developing inclusive digital solutions. Microfinance institutions, meanwhile, have considerable leverage to promote the economic inclusion of women by providing them with access to credit, savings, insurance, and training tailored to managing small income-generating businesses.

Investing in refugee women means investing in the resilience of communities. It means recognizing their economic, social, and community potential, which is too often ignored or underestimated. Lisungi’s experience demonstrates that another option is possible, even in the most fragile contexts. It is a powerful reminder that, when supported in a fair and consistent way, refugee women are not passive victims but genuine agents of change, capable of breathing new life into battered territories.

As eastern DRC faces a critical period, it is urgent to draw inspiration from this success story and deploy responses that meet the needs. Whether through public funding, international donations, or responsible investment, all stakeholders—financial institutions, governments, and NGOs—have a role to play to ensure that no one is left behind, and that women like Claudine can continue to bring about change.

UPCOMING EVENTS:

– Training on green products, July 2025, Lomé-Togo

– Training on management and assessment of vulnerabilities, July 2025 Kigali- Rwanda

– Training on the facets of EST and gender, August 2025 Lomé- Togo

– Training on female leadership, August 2025 Lomé- Togo

[2] https://www.plugimmo.pro/green-real-estate-loans-in-2024-an-opportunity-to-finance-energy-renovations/

[3] https://www.afd.fr/fr/actualites/communique-de-presse/fonds-vert-climat-efficacite-energetique-batiments-11-pays

[4] https://www.unep.org/en/news-and-stories/press-release/emissions-from-the-global-building-sector-remain#:~:text=The%20report%20indicates%20that%20a%3A%20third%20of%20global%20demand.